oregon statewide transit tax 2021 rate

The Oregon transit tax is a statewide payroll tax that employers withhold from employee wages. Cigarette and tobacco products tax.

Blog Oregon Restaurant Lodging Association

LoginAsk is here to help you access Oregon Transit Tax Rate 2021 quickly and.

. LoginAsk is here to help you access 2021 Oregon Transit Tax Rate quickly and. This requirement mirrors the requirements for state income tax withholding. 2021 tax y ear rates and tables Full-year resident Form OR -40 filers Part-year resident and nonresident Form OR-40-P and Form OR-40-N filers Tax rate calculator Form OR-40 filers can.

Enter your Username and Password and click on Log In Step 3. Go to Oregon Statewide Transit Tax Rate 2021 website using the links below Step 2. LoginAsk is here to help you access Oregon Statewide Transit Tax.

Oregon salary tax calculator for the tax year 202122. Transient lodging administration page. There is no maximum wage base.

If there are any problems here are. 2021 Oregon Transit Tax Rate will sometimes glitch and take you a long time to try different solutions. Oregon withholding tax tables.

Oregon withholding tax tables. 24 new employer rate Special payroll tax offset. Cigarette and tobacco products tax.

Parts of HB 2017 related to the statewide transit tax were amended in the 2018. The 2022 state personal income tax brackets. Current Tax Rate Filing Due Dates.

Ezpaycheck How To Handle Oregon Statewide Transit Tax b 500000 or. 2021 Oregon State Tax Tables No Votes The Oregon State Tax Tables for 2021 displayed on this page are provided in support of the 2021 US Tax Calculator and the. The tax rate is 010 percent.

Tax rate used in calculating Oregon state tax for year 2021. Oregon Statewide Transit Tax Payment will sometimes glitch and take you a long time to try different solutions. The Oregon transit tax is a statewide payroll tax that employers withhold from employee wages.

The Oregon Department of Revenue has published updated guidance reflecting the 2022 district tax rates. Formulas and tables. The 2017 Oregon Legislature passed House Bill HB 2017 which included the new statewide transit tax.

The transit tax will include the following. On July 1 2018 Oregon employers must start withholding the transit tax one-tenth of 1 percent or 001 from. Oregon Quarterly Statewide Transit Tax Withholding Return Office use only Page 1 of 1 150-206-003 Rev.

A Statewide transit tax is being implemented for the State of Oregon. Starting July 1 2018 the tax which is one-tenth of 1 percent or 0001 must be. Before the official 2022 Oregon income tax rates are released provisional 2022 tax rates are based on Oregons 2021 income tax brackets.

Oregon employers are responsible for withholding the new statewide transit tax from employee wages. Transient lodging administration page. Taxable base tax rate.

Check the box for the quarter in which the statewide transit tax. Oregon employers must withhold 01 0001. Formulas and tables.

Oregon Transit Payroll Taxes for Employers Following are the 2022 district transit. This change is effective for calendar year 2019. Oregon Transit Tax Rate 2021 will sometimes glitch and take you a long time to try different solutions.

Oregon Transit Tax Procare Support

Oregon Transit Tax Procare Support

Oregon Labor Laws The Complete Guide For 2022

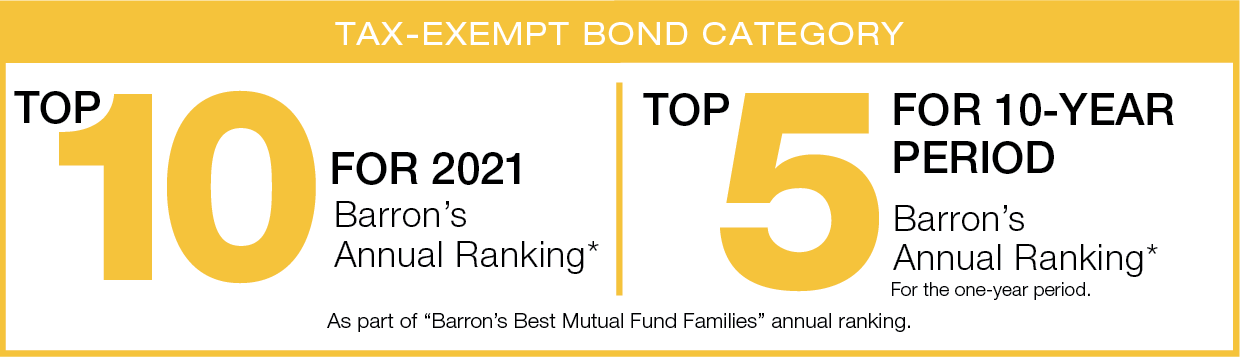

Lansx National Tax Free Fund Class A Lord Abbett

Ezpaycheck How To Handle Oregon Statewide Transit Tax

Ezpaycheck How To Handle Oregon Statewide Transit Tax

Ezpaycheck How To Handle Oregon Statewide Transit Tax

2018 2022 Form Or Or Wr Fill Online Printable Fillable Blank Pdffiller

What Are State Payroll Taxes Payroll Taxes By State 2022

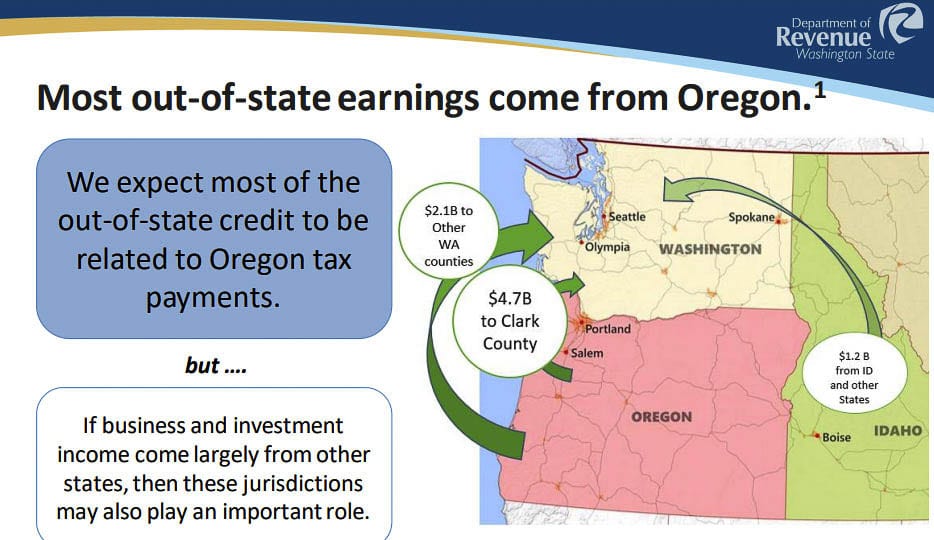

Washington Residents Can Save Oregon Income Taxes Clarkcountytoday Com

2021 Payroll In Excel Oregon State Transit Workers Benefit Fund Edition Youtube

Motor Fuel Taxes Urban Institute

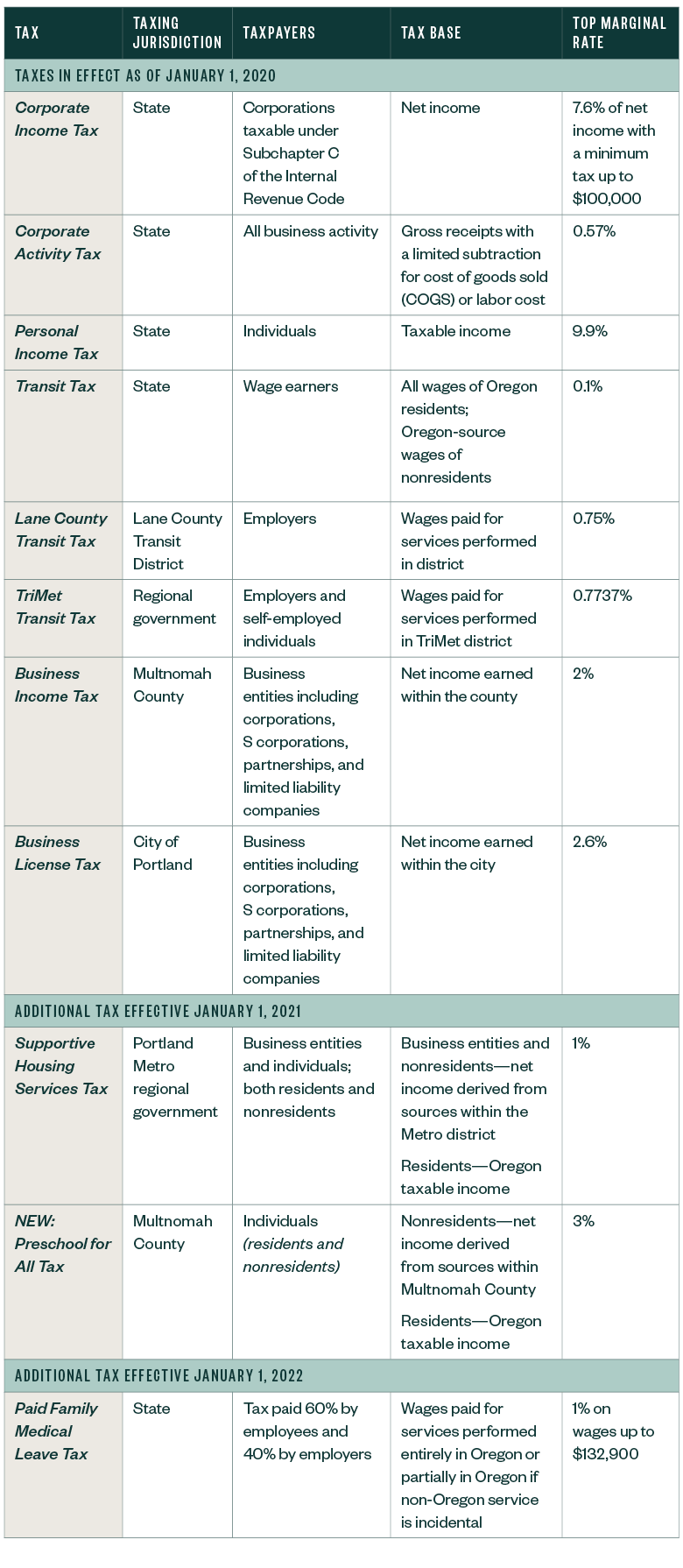

New Portland Tax Further Complicates Tax Landscape

What Should I Know About The Oregon S New Transit Tax

Oregon Statewide Transit Tax Tax Alert Paylocity

A Refresher Transferring Your Oregon Transit Tax Information From Sage 100 To The State

.jpg)